The outlook for economic growth has dramatically worsened over the past week as Covid-19 fears have taken hold. On the back of this, earnings expectations and the macro outlook have also materially deteriorated. This increased uncertainty is reflected in risk market pricing, including high yield.

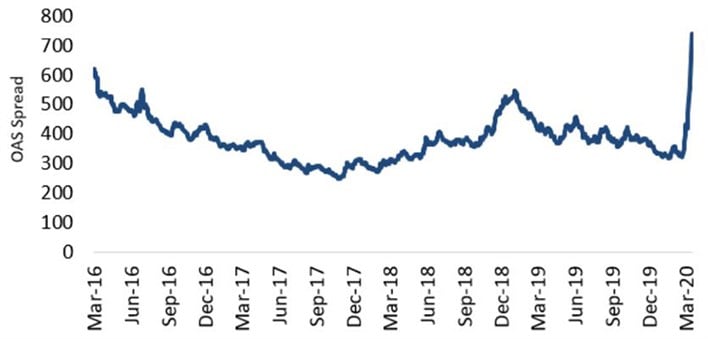

Specifically, European high yield strategy spreads have widened by more than 300 basis points since the end of February (see Figure 1):

Figure 1: European high yield spreads

Source: ICE BofAML indices, as at 17 March 2020

Figure 2 below, meanwhile, shows the year-to-date basis spreads. Macro fundamentals are pointing to the likelihood of a negative growth impact from Covid-19. While corporate balance sheets are reasonably well positioned, future earnings are uncertain given the knock-on effect of the virus. Outflows for US high yield strategies have increased in recent weeks, with last week posting a $5.1 billion outflow, the largest for the asset class since early 2017, following $4.2 billion the previous week.

Figure 2: Changes in European high yield spreads in 2020

Market | 16/03/2020 | 31/12/2019 | Change bps | Change % | 2020 observations |

|---|---|---|---|---|---|

Europe | 740 | 329 | 411 | 125% | Europe outperforming |

BB | 544 | 215 | 329 | 153% | High quality credit underperforming |

B | 1079 | 434 | 645 | 149% | High quality credit underperforming |

CCC | 1409 | 895 | 514 | 57% | Lower quality credit outperforming |

USA | 838 | 360 | 478 | 133% | US underperforming |

BB | 616 | 202 | 414 | 205% | High quality credit underperforming |

B | 917 | 356 | 561 | 158% | High quality credit underperforming |

CCC | 1620 | 1008 | 612 | 61% | Lower quality credit outperforming |

Energy | 1921 | 673 | 1248 | 185% | Energy underperforming |

Source: ICE of BofAML indices, 17 March 2020.

In European high yield, last week’s outflow was around €2 billion, of which €760,000 was in ETFs. The new issuance market has also come to a halt. Still, as active managers we continue to see some potential “pearls in the rubble” as certain sectors and names, which earlier were deemed “expensive” given their tight spreads, now start to look interesting as valuations have become more attractive.

Since the start of the year the portfolio has been moderately underweight market beta and maintains on a sector basis an underweight in cyclicals such as autos, transportation and basic industries, while it is overweight in healthcare, technology, media and financial services. Recent activity includes raising cash through the sale of some short-dated maturities, which had performed well and were starting to look expensive, in case of short-term liquidity needs. We also reduced holdings in some names in the transport, energy and leisure-related sectors.

We expect further disruptions to come due to the coronavirus situation and its ramifications. The most recent few trading days have shown that the market is highly stressed and showing signs of disruption. The wider markets are now driven by the shock to the real economy and by political decisions in response. This is moving the market into unchartered territory and making it difficult to assess. What had started initially as a typical sell-off where weaker credits sold-off heavier than stronger credits, has now developed into a more indiscriminate sell-off across all sectors and all rating classes within high yield. Sectors which normally are relatively stable, e.g. leisure parks, are now experiencing a structural shock for which it is hard to say how long it will take for the recovery. Given how indiscriminate the recent sell-off has been, it is a challenging environment which will remain highly volatile and uncertain as things can change very quickly.