Our thoughts on the world today

Global economic activity has suffered a “sudden stop” as authorities have sought to contain the spread of the Covid-19 virus by shutting down economies. We have seen early signs of its impact in the data; for example, low single-digit European PMIs, and US employment where the entirety of all jobs created since the Global Financial Crisis (GFC) have been lost in six weeks. Indeed, the current quarter, covering much of the lockdown period itself, is set to worsen considerably.

Against this, stimulus from central banks and governments has been tremendous, far exceeding what we saw in the GFC in scale and speed. Balancing the cost of shutdowns with the benefits of stimulus, our central forecasts point to economic activity in the US regaining Q4, 2019 levels by the end of next year, in something of a “U-shaped” recovery. Europe, the UK and Japan meanwhile, are more likely to experience a more protracted slowdown, recovering to last year’s GDP level some time after the end of 2022.

To our minds, therefore, the economic consequences of the pandemic will be very large but ultimately temporary, albeit longer lasting than the current consensus expects. Companies will also emerge with more indebted balance sheets.

Are governments and central banks around the world doing enough?

The monetary and fiscal response in major developed markets to this crisis has been astonishing, in both magnitude and speed of delivery. The Federal Reserve, for example, has done more in three weeks than it did in the entire GFC, and the US government fiscal deficit is poised to rise from 5% to 20% by the end of this year, a discretionary expansion without precedent. The ECB, meanwhile, has committed to buy government and corporate bonds at a rate never seen before and without the shackles of previous programs, helped by government credit guarantees and forbearance measures to keep companies and markets functioning.

It remains to be seen if even more will be required to “fill the hole” in economic activity. What is clear though is that major central banks and governments have shown a willingness to do “whatever it takes”, which is encouraging. Emerging markets have had less policy room to stimulate.

Where next for asset markets?

The market response has also been astonishing, with sharp falls (and then rises) across equities and corporate bonds, a jolt higher in volatility and a meaningful rise in cross asset correlations. Developed government debt has rallied hard as markets sought safe havens and priced in ever lower-for-longer policy.

Looking forward, although risk assets are highly sensitive to where economic growth – and company earnings – end up, huge uncertainty around those variables and a meaningful policy response to bridge the gap may mean investors can “look through” the short-term worry. However, with companies likely to emerge from this crisis with greater leverage/worse balance sheets than before, our focus has been on higher-quality companies in both credit and equities. We are cautious on government bonds at these levels, particularly given sharply deteriorating fiscal accounts as policy makers seek to manage the crisis.

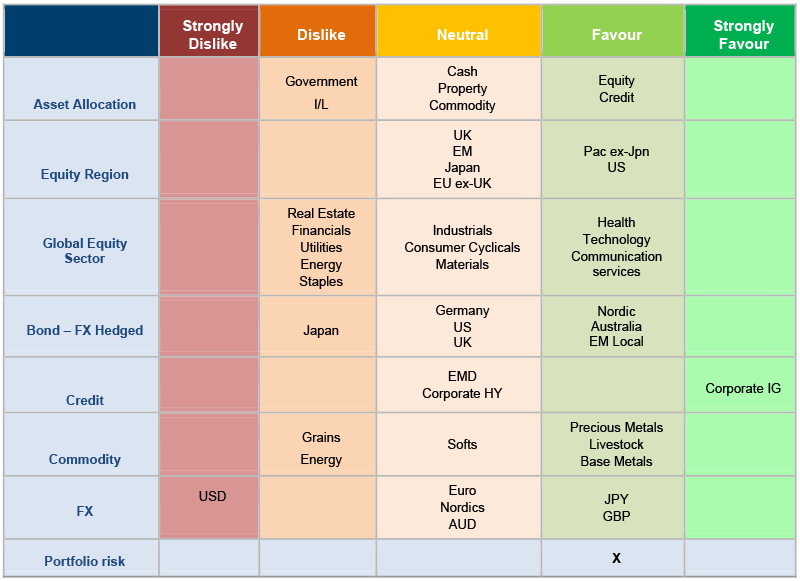

Figure 1: Asset allocation snapshot

Source: Columbia Threadneedle Investments, 21 May 2020.

Asset Allocation Changes

With the depth of weakness in economic data even more pronounced than many expected and yet to be reflected in analysts’ earnings expectations, we have sought to reduce cyclicality in multi-asset portfolios, notably through reducing UK and Japanese equities in favour of the US.

At the same time, we want to participate in select risk markets, particularly those that have cheapened, and which stand to benefit from policy measures. Through the crisis, therefore, we have increased both the quantity and quality of risk that we are taking.

Within equities, this leaves us with a preference for the US and Asia ex-Japan in a barbell of quality growth and cyclical exposure. The US market offers exposure to quality companies with strong balance sheets which look able to grow earnings even in this uncertain environment. In emerging Asia meanwhile, some cyclical exposure should be rewarded as the region pulls out of this crisis and parts of its economy – such as Chinese manufacturing – show signs of reverting to pre-virus levels.

In seeking to take quality risk in fixed income too, we have a strong preference for investment grade credit, where well-capitalised companies look best-placed to weather the storm. While spreads have tightened from their late-March wides, they remain cheap to long-run averages, and the technical environment has improved with vastly better liquidity conditions and a return to primary issuance. The fundamental picture, meanwhile, appears relatively sound, as high-grade credit is a targeted beneficiary of the policy response to the crisis.