The first official measures of the economic impact of coronavirus are being released, and it is now all but inevitable that we will see a deep contraction in economic activity in the US as a result of the shutdown implemented to contain the virus.

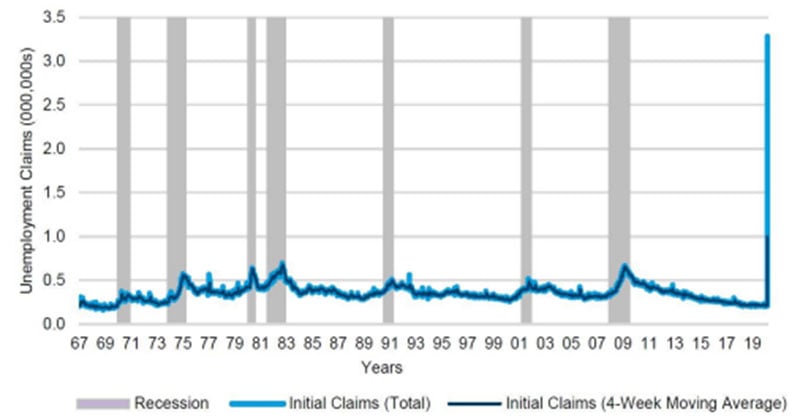

At the end of March initial jobless claims, as reported by the US Department of Labor (DOL), spiked to more than 3.2 million – a new record. Future DOL reports are likely to show further increases in the coming weeks, and it is very likely that we will see the unemployment rate, until recently at historic lows, now rise to 6% in April and perhaps to 9-10% in the coming months.

Figure 1: Unemployment claim spikes have been reliable indicators of recession

Source: US Department of Labor/Columbia Threadneedle Investments, 21/3/2020

Labour market data is the most reliable indicator that a US recession is underway and is one of the more certain statistics we can observe in the current environment. The present situation is so novel (like the virus itself) that applying historical models to forecast what we may see is a significant challenge. Unlike most post-WWII recessions (such as a result of the business cycle overheating or financial bubbles), what we are experiencing now is the intentional suspension of economic activity. Given that we don’t know how long the shutdown may last, it is now almost impossible to predict US growth in the near term, i.e., the second quarter.

The base, bull, and bear case

From an investment perspective, we frequently present three scenarios in terms of base, bull and bear cases. Presently, our base case assumes that the US is in near complete lockdown for six weeks or more. As a result, airlines, restaurants, travel and leisure and many other sectors will struggle to survive, and there will be second order effects.

The multiplier effects and the likelihood that consumers will not return to “normal” activity immediately implies that a recovery in economic activity may not occur until the fourth quarter of 2020. In our view, a quarterly sequence of GDP growth consisting of a very sharp decline for the second quarter, weakness in the third quarter, and perhaps a decent bounce in the fourth quarter will translate into -2% to -4% negative year-on-year GDP growth. Further, our view is that we will almost certainly see a sharp decline in year-on-year earnings.

A more protracted period of economic shutdown, one that lasts longer than the next couple of months, could translate into a longer global recession, well into 2021. If widespread testing allows people to come back to work faster than anticipated, or if some therapeutics designed to relieve the impact of the virus are discovered, the outlook can be more optimistic.

It is easy to feel overwhelmed by these numbers, and while a recession now appears a certainty, central banks and elected officials have mounted a swift and substantial response. The Federal Reserve (Fed) and central bankers globally very quickly announced measures to keep markets liquid and credit flowing. Monetary policy is fully accommodative and very focused on liquidity and solvency issues, with many new programmes introduced, aimed at making credit available to banks and other institutions. The Fed can now purchase almost any fixed income-related security – including ETFs and excepting high yield bonds – and has established itself as the lender of last resort. Fiscal stimulus in the US aimed at reducing funding stress and stimulating growth is on track to exceed $2 trillion. In addition, measures to reduce regulatory oversight are being considered.

These are encouraging actions to support the economy. Nevertheless, economic data in the coming months is likely to paint a bleak picture. While many of these measures are lagging indicators, and may already be priced into markets, the cumulative drumbeat of grim news could weigh on investor sentiment.

Looking ahead

Ultimately, the duration and the intensity of this unprecedented economic contraction depends on the duration of the shutdown. We take some encouragement in the swift and substantial ongoing policy response from monetary and fiscal authorities to help consumers and businesses cushion the blow. As the virus-induced shutdown ends and activity begins to normalise, we expect claims and the unemployment rate to edge down, and a long road to recovery to begin. After a rude shock, US activity should slowly return to normal levels.