The coronavirus is a clear shock to the world economy. In its nature the disease is very different from the likes of SARS and swine flu in that the transmission rate is far higher and mercifully the death rate is much lower. The other difference is that the infection has now clearly left Asia. Europeans and people in the US had been comfortable that this was a China issue with selective outbreaks in the rest of Asia, but that view of markets has been shattered with the S&P and other world markets well off their recent highs.

What will the economic impact be?

So far we see two clear impacts: lost consumption and lost supply. Looking to China, as the disease becomes the dominant factor in people’s thinking consumption falls. A recent Adidas market update stated that its Chinese business had fallen by 85%1 – at that level there is little mileage in analysts trying to second guess the numbers.

It is a clear disaster, but it is temporary.

In a few months, and certainly before the end of this year, we will likely be back on trend. However, I suspect a significant portion of the drop in consumption will be lost forever. While we might still ultimately replace a smartphone, we are now unlikely to buy that new spring season outfit.

The second element is supply disruption, where we are seeing clear evidence of critical component shortages leading to underproduction. Again, if inventory is unavailable it will miss consumer demand and a portion will ultimately be lost. In some industries where inventory cycles are the norm, we will enter a period of inventory adjustment, and the depth of the down cycle and how global this event becomes will determine the required period of adjustment.

It looks likely that we could have another “industrial recession” driven by the coronavirus, similar to the 2012 euro crisis, the 2014-15 oil price collapse, and the 2018-19 trade dispute-driven slowdown. None of these events triggered an overall recession, and given the temporary nature of the coronavirus event we would not anticipate one this time – though in the case of Japan and perhaps Germany we might see one, albeit mild.

Companies will experience a period of negative earnings revisions which will continue to impact the market, even if its capacity to shock becomes limited. While we have not made a formal estimate, it is possible we will see earnings downgrades of double figures – this was the impact of the aforementioned viral slowdowns and would be enough to remove the earnings growth forecast for this year.

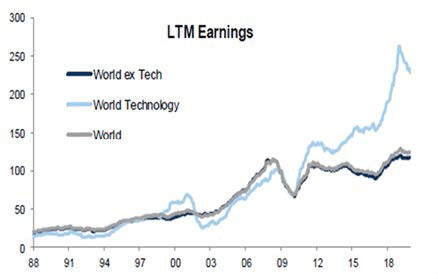

Another way of thinking about this is that the slow growth environment the world economy has experienced since the global financial crisis will continue. During that period the average company has struggled to grow earnings. Figure 1, for example, shows the development of global earnings relative to the tech sector over that period.

Figure 1: Companies last 12 months earning (1988-2019)

Source: Goldman Sachs, December 2019.

Coronavirus as an event means this trend will continue in 2020. Of course, it is not just technology businesses that fit this category, but also medical tech and quality growth businesses that can deliver in all economic environments.

In the medium term one of the clear implications that coronavirus brings is further pressure to diversify or even shorten supply chains. For the past 30 years the successful model for a western business has been to lengthen supply chains to access cheaper inputs in low wage economies, of which China has been the poster child. President Trump has provided political resistance to this; coronavirus adds a focus on security of supply.

Over the next decade as the use of artificial intelligence increases, the frequency with which companies make, for example, demand forecasts will rise, and the way businesses will take advantage of these insights is with a shorter, more agile supply chain with automation helping to offset the resultant cost pressures.

Finally, while the above discussion provides a framework for thinking about the impact of coronavirus, it is a fast-changing situation. I hope you all stay safe.